Houston Uber & Lyft Accident Lawyers

The convenience of rideshare services like Uber and Lyft has led to their explosive growth over the past few years. But increasing numbers of Uber and Lyft drivers on the roads and highways around Houston has meant a corresponding increased risk of motor vehicle accidents involving Uber and Lyft vehicles. People who are hit by an Uber or Lyft vehicle or passengers in an Uber or Lyft who are injured when their ride gets into an accident, deserve to be compensated for their injuries and losses. However, you need dedicated legal representation to ensure that you receive fair and full compensation for your injuries.

At The Law Offices of Hilda Sibrian™, we’ve been helping injured accident victims recover since 2004. We see our clients as more than just cases. From the moment you enter our doors, you become part of our family. We strive to provide the personalized attention and quality legal representation you deserve after being injured through no fault of your own.

Contact our firm today for a free initial case evaluation to discuss how a Houston Uber and Lyft accident attorney can help you maximize your recovery from your injuries and losses following an accident.

Why Choose The Law Offices of Hilda Sibrian™?

When you’ve been injured in an accident such as an Uber or Lyft crash, you need the right car accident attorney and law firm to help you secure financial recovery for your expenses and losses. Choose The Law Offices of Hilda Sibrian™ for help in recovering from serious and catastrophic injuries after an Uber or Lyft accident. Our firm’s case results speak to our track record of obtaining successful outcomes on behalf of our clients, including multiple six-figure awards for clients gravely injured in motor vehicle accidents.

Choosing The Law Offices of Hilda Sibrian™ can provide you with other benefits in your Uber or Lyft accident case, including:

- Being able to contact us via our 24/7 hotline.

- Having the opportunity to speak to an Uber accident attorney during a free consultation to understand your rights and options and how we can help.

- Available transportation to our office.

- Fully bilingual, Spanish-speaking attorneys and staff.

- A firm focused exclusively on personal injury cases, with the successful case results to show for it.

- Legal team members with backgrounds in biology and human sciences, which help us fully understand your injuries in the context of your legal claim.

- Aggressive advocacy aimed at securing an effective but fair resolution to your claim that provides you with maximum compensation.

- A no-fee pledge, meaning we do not get paid unless and until we win compensation for you.

What Happens When You Are a Passenger in an Uber Accident?

Similar to when you are in an accident in a private car, when you are a passenger in an Uber accident call 911 if necessary and seek medical attention. Even if you do not think your injuries are serious, it is still a good idea to get a medical evaluation to rule out any internal injuries and to legally protect yourself if injuries manifest later.

If possible, use your phone to snap photos and videos of the crash scene and of the damaged cars. It is also a good idea to jot down as much information as you can, including:

- Your driver’s name and information

- Any other involved parties’ names, contact information, and insurance information

- The contact information for any bystanders who saw the crash

If issues arise when you file a claim, the information that you collect can be very helpful in proving your case.

What should I do after an Uber crash?

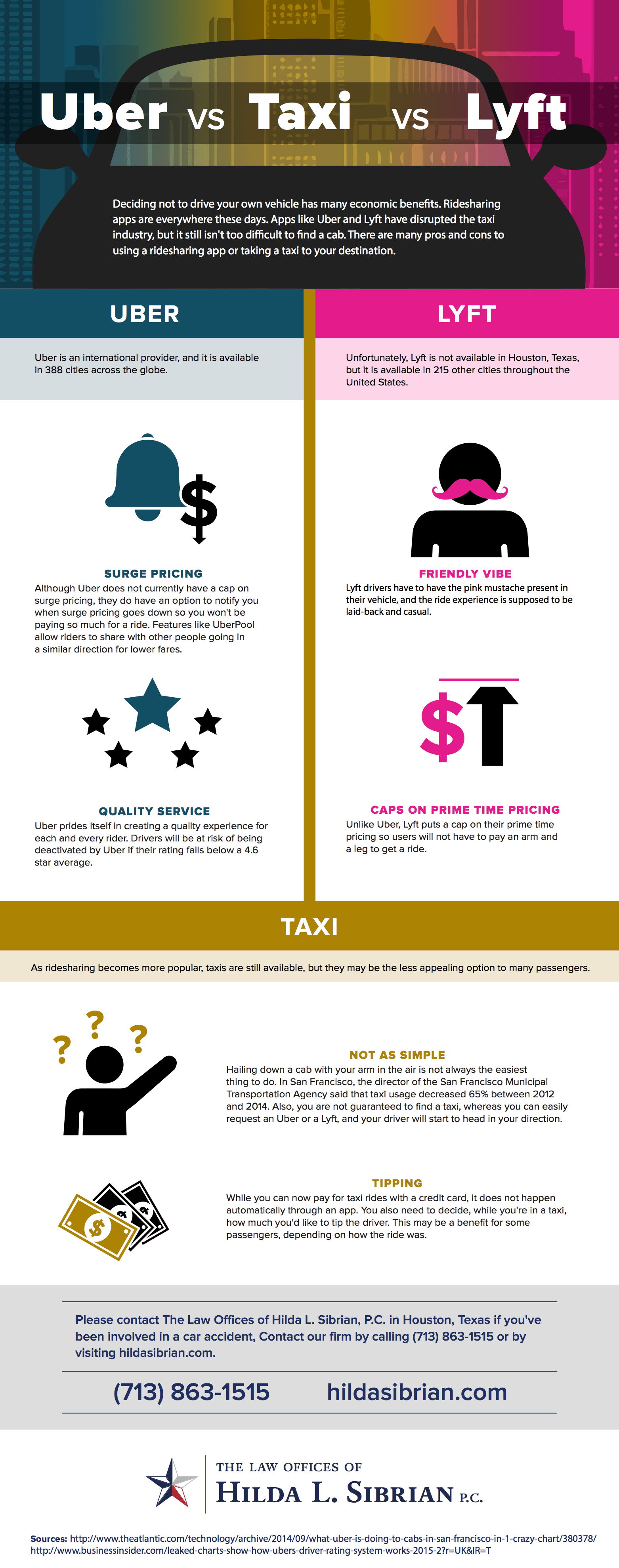

Chances are, if you have not grabbed a ride with Uber, you have at least heard of it. You may have heard friends singing its praises, or you may have seen that a driver was involved in an accident.

Company spokespersons say that all drivers must submit to background checks and that drivers who demonstrate patterns of unsafe behavior (like crashing) will no longer be able to drive for Uber.

Even still, Uber accidents can and do happen. For those who use ride-sharing companies like Uber, it is important to know what to do if you are ever in an accident and how to receive payment for any injuries or other losses you sustain.

What Compensation Can I Receive for an Uber Accident?

You may be entitled to compensation for expenses and losses that you’ve incurred due to the accident, including:

- Medical expenses, such as hospital bills, surgeries, and prescription costs

- Rehabilitation costs, including physical or occupational therapy

- Long-term care costs, such as home health care services, when you are seriously injured

- Lost wages and income when you miss work during your recovery

- Lost earning ability, if you are disabled from gainful employment

- Loss of enjoyment or quality of life, such as due to physical scarring or disfigurement, or due to physical disabilities that impact your daily living

- Physical pain and emotional distress

- Property damage, such as damage to your vehicle that was involved in the accident

How Long Do I Have to File My Uber Accident Claim?

You generally have two years from the date of your accident to file a personal injury lawsuit under Texas’s statute of limitations. If you file suit after the statute of limitations has expired, you run the risk of the court dismissing your case and losing the right to seek financial compensation for your injuries and losses.

Who Is Liable in an Uber or Lyft Accident?

Texas’s rules regarding general liability in car accidents still apply if you are injured in or by an Uber or Lyft vehicle. The at-fault party bears financial responsibility for the accident and the damages you sustain. The at-fault party might be the Uber or Lyft driver or it may be another driver.

When the Uber or Lyft driver causes the accident, other injured parties may turn to the rideshare company for compensation. Texas law requires rideshare drivers to carry certain minimum insurance coverage. This coverage is usually furnished by the rideshare company for their drivers. The exact amounts of available coverage depend on the circumstances at the time of the accident.

If an Uber or Lyft driver is not logged into the rideshare service’s mobile application and has not designated themselves ready to accept ride requests, then the driver is not considered to be driving for Uber or Lyft. Any accident that occurs during this time will be handled by the driver’s own auto insurance policy.

If the driver is logged into the application but has not received a ride request at the time of an accident, Uber and Lyft provide $50,000 per person, $100,000 per incident in bodily injury liability coverage, and $25,000 in property damage coverage under Texas law.

If the driver has accepted a ride request or has a passenger in their vehicle, Uber’s and Lyft’s insurance coverage increases to liability coverage of $1 million.

Contact an Uber and Lyft Accident Lawyer

If you were injured in a car accident with an Uber or Lyft vehicle, turn to the attorneys of The Law Offices of Hilda Sibrian™ today for a free, no-obligation consultation with a Lyft and Uber accident lawyer. Don’t wait to learn more about your legal rights and options for seeking compensation for the injuries and losses you’ve suffered from the accident. Our dedicated attorneys are available to discuss the details of your case during a free consultation. We can devise a legal strategy to pursue the maximum compensation available for your claim. Contact us or call us today to get started.